059. Scaling…Everything

“Microsoft Becomes First $500-billion Company" —Bloomberg News headline July 17, 1999

It is one thing to change a product in order to meet market needs, but entirely another to change the culture. Scaling the teams and processes to meet the needs of our high-paying enterprise customers was another effort, and one that came right when most external indicators made it seem like we were doing everything right, thus making change more difficult. In practice, we had significant challenges meeting the needs of enterprise customers—product, support, quality, and overall enterprise-ness. We needed to bring not just our software to enterprise readiness, but our organizations. The best way to do that is to live through a few crisis moments, whether self-inflicted or not. Microsoft never met a crisis it didn’t enjoy to some degree.

Back to 058. That Dreaded Word: Unification

Note: This post is trying out the new free preview feature.

Increasingly, our newly minted enterprise customers grew frustrated with Microsoft’s readiness as an enterprise partner. When an enterprise customer is frustrated, they describe the company as a vendor rather than a partner. A vendor is what we used to be, or so we thought. We had to up our game.

Customers were sitting on a mismatched pile of software from Microsoft, some of which was by all accounts being ignored by us in the product groups. There were ATMs running OS/2, which we long ago turned over to IBM. Banks in Europe were running Word and Excel on OS/2, which we made as essentially a one-off. One of the leading business magazines had a publishing system that used Word 2.0 and Windows 3.0, from the early 1990s. That was 8 years ago, an infinity in software years. We had moved on from those products. Our customers had not.

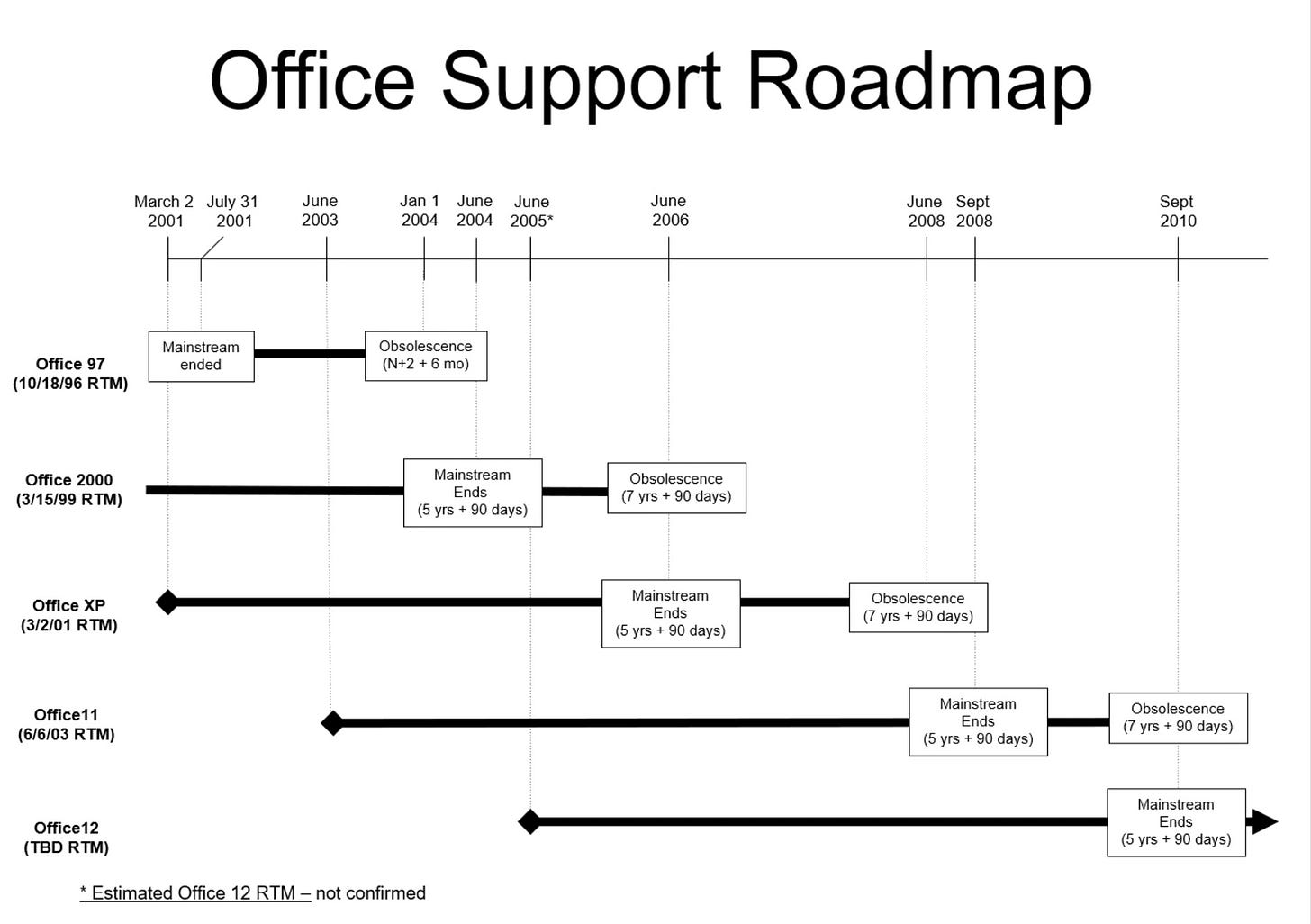

Business is business and Microsoft needed to change. While it took us more than a year of meetings, in 2002 we finally announced a Support Lifecycle Policy. To much press and customer outreach we announced that Microsoft products would now have a minimum of five years of product support. In the Microsoft blog post describing the new policy, the CVP Product Support Services, Lori Moore (LoriM), explained that we “worked closely with customers, business and industry partners, leading analysts, and research firms”. Noticeably absent from that were the product groups that would be on the hook to deliver bug fixes and updates to customers covered by Software Assurance as part of this new policy.

It should be no surprise then that Microsoft’s fully distributed and empowered product groups interpreted this policy with differing levels of enthusiasm. Did it apply retroactively? What about products designed for consumers? What if we have multiple releases over five years? What if product releases took more than five years? What if Exchange has one interpretation and Outlook another? The intended effect of this effort was to do good by enterprise customers.

Instead, it was just an early step in making the transition to a new operating model. Customers interpreted the Lifecycle as a license to deploy what they could or would and then freeze the infrastructure for at least five years. Imagine in our fast-changing technology world, just freezing a company’s information infrastructure. Five years was the minimum. Customers could even buy longer support contracts and they did so in droves. It meant that even five years from now, product groups were on the hook to support products that no one was actively working on.

That said, in Office we created a team that grew significantly over the years of full-time engineers dedicated to what we termed Sustaining Engineering. The team, Microsoft Office Sustaining Engineering (MOSE), originally envisioned by Excel test manager Carl Tastevin (CarlT) and then led for many years by former Word test manager Jeanne Sheldon (JeanneS), prided itself on being a direct connection to customers. They would spend the time to understand the context and customer environment driving problems and were reliably the best source of information anywhere for how the product was performing in market with customers. The team was not an outsource model for quality and fixes because the product team developers that created the problems were accountable for fixes. It was a fantastic model for us and one we would later replicate in Windows which had gone full outsourcing after Windows XP shipped, which turned out to be less than ideal.1

It would not take long, not even eighteen months, and the policy would again be updated. The feedback was less than positive on the first policy, mostly because it was uneven across the company and hardly long enough compared to traditional enterprise partners. This time the product groups were deeply involved in the process, in what grew to a major corporate undertaking. Since the first announcement, most teams released major new products, and all had built out engineering teams that were able to handle the new volume of support issues from enterprise customers. I attended many of the meetings of the product leaders who were trying to agree on a more uniform policy. The group was working well together but not converging. Microsoft’s multiple billion-dollar businesses each serving distinct customer types and each with substantially different release schedules were struggling to arrive at a more uniform policy that was also longer. Some product groups aimed for very long support terms and others wanted nothing to do with previously released products. Office was in the middle. The position depended entirely on the primary buyer such as IT professionals, OEMs, or general corporate buyers.

In a moment of frustration for how long this was dragging out, I, probably the most senior product group person in the room, suggested (with some force) we should all settle on a ten-year support offering. This would make customers happy and would put this issue to rest. Our competition, such as IBM, supported products for decades. How much support would customers really expect nine or ten years from now for a product long forgotten? What a huge mistake I made. In hindsight, I was intoxicated with the idea of making sure the field (and SteveB) knew we “got it” in the product groups and also over-confident with the idea that we could execute on such a commitment. I really can’t believe I thought this was a good idea—not only for Microsoft but for customers to rely on it. Think of all that changed ten years prior or all that would change from 2000 to 2010, especially considering how most customers were still far away from deploying email and the internet. Yet, SteveB and the field support and sales teams were incredibly happy and thankful for the teamwork and support from the product groups it took to make the updated policy a reality. Ten years.

You could feel the bubbles and the froth everywhere as the end of the millennium approached in the Fall of 1999.

Microsoft was in the midst of an all-out frenzy of activity in late 1999. First and foremost, the company’s main business drivers were firing on all cylinders. Combined, Windows and Office were on pace for almost $18 billion in revenue and enormously profitable. Microsoft was growing at a rate of nearly 30 percent per year in revenue and would end the year with over $20 billion in cash on hand—truly unfathomable numbers. Wall Street responded with an unheard-of market valuation of over $600 billion and a position as one of the (if not the) world’s largest and most successful companies. BillG’s wealth was valued at over $100 billion dollars, personally.

The Microsoft vision was expansive. No software escaped Microsoft’s attempts to enter and redefine a market with PCs and software. It was a crazy time. Anything that came up in the news or could be read about had a project and team somewhere at Microsoft working on it.

As if that wasn’t enough, the burgeoning online division spun out home-grown Expedia as a separate company with an initial public offering that leaped 282 percent on the first day of trading. Microsoft acquired LinkExchange for $250 million to bolster online advertising. The Applications and Tools Group, of which Office was a part, acquired Seattle neighbor Visio, makers of a business drawing application, for one point five billion dollars, making the previously huge Vermeer acquisition look trivial. When we weren’t making money, we were spending it. New buildings were going up. Morale events, offsites, and endless ship meals (for all those late products) were getting more elaborate. Unopened PCs laid in hallways waiting for new hires to show up. Servers piled up in our ever-expanding online data centers waiting to be racked and stacked.

The focus on the enterprise was paying off handsomely and we were in middle of a profitable and maturing PC era. Growth in units and revenue for Windows and Office were not slowing, but the revenue growth outside of those was increasing faster. BillG recognized this, and in the early fall 1999 authored a widely distributed memo with the priorities for the following year. Windows 2000 was the priority, and it was going to ship real soon (it shipped to customers six months later). The other priority was what Bill was referring to software as a service in a September 1999 email to all employees with the subject “Changing the World Together”:

The other very significant focus for us in the years ahead will be providing software as a service. This won’t in any way change our commitment to the PC. But adding to that focus, we will be developing exciting new technologies to provide software as a service across a range of devices in the enterprise, to small business and to consumers. The goal is to maximize simplicity, flexibility, manageability and responsiveness to customer needs and interests. Software as a service reflects a fundamental change in the way we will be designing, integrating, deploying, licensing and supporting technologies, so there’s lots of exciting work ahead.

In terms of history, while IBM leased software for years, the phrase was first used by BillG in reference to the company strategy and quickly followed up by articles describing this across major news outlets. Silicon Valley was using the phrase Application Service Provider or On-demand Software.

It was not lost on me that Bill’s memo did not mention Office. Office was fading into the background as senior executive leadership was increasingly formed from Windows and Server alumni. In a big company when the most profitable and highest revenue team doesn’t get a shout-out, people notice. The team noticed. I do not think the omission was intentional, but rather a byproduct of where he was focused and was spending time.

The early projects for software as a service were incubated by a cross-section of systems and online services senior architects and engineers. Across the company we had countless offsites, meetings, memos, slide decks, and more working to develop a plan, all while the Office team was busy planning and executing a new release of Office while most of the company was just finishing releases. In many ways the first software as a service efforts followed the Innovator’s Dilemma playbook by not sharing connections to the main product groups. For time being these incubations were under the radar, but that would change soon enough—Microsoft couldn’t help itself.

Notably absent from the flurry of activity were competitive concerns. Microsoft appeared to have won the battles that a just couple of years earlier seemed existential. The internet did not end up dominating Microsoft’s traditional business, but rather Microsoft’s traditional business morphed into internet businesses; Wall Street certainly thought so. Windows laptops became the preferred gateway to the internet for consumers, with AOL purchasing Netscape for $4.2 billion on the heels of poorly received products, such as Netscape 4.0 compared to a winning Microsoft Internet Explorer 4.0. Windows NT Servers (eventually updated to Windows 2000) were becoming a corporate standard. Nobody else was making much of a dent in the Office business—not Office competitors, Java, components, or in the browser space. Sun even acquired a clone of Office, a Win32 suite of desktop apps, and then subsequently made it available for free, yet even that was not having an impact.

The antitrust cases continued, but day to day this was a matter for the legal team and not the product groups. The business press heralded Microsoft’s success as one of the great turnarounds of business history, a pivot, as in Microsoft pivoted to an internet focus.

One layer below all of this was a significantly different story.

Microsoft’s success in transitioning to internet technologies was financially successful but strategically weak. Microsoft lost the mindshare of developers—while Windows was a great place to run a browser, it was no longer the preferred platform for writing software. Microsoft was using many internet standards, such as HTML and HTTP, but our influence on those standards was minimal.

It is abundantly clear today as I write this, that the decline of relevance of Win32 as a developer strategy began as early as the early 2000s. Except for the big software companies like Adobe and Autodesk, and the vast array of line of business client-server applications written by in-house IT, there just weren’t any new and exciting applications written for Windows natively. Windows Server was new, but again never really saw a level of investment in unique apps on par with expectations, especially compared to the internet. The most exciting developments going on were browsers, web servers, and software built on those, and there was little at all specific to Windows. It was just that at the time and for the next five years or so most everyone happened to run Windows and Windows Server, giving the appearance of a vibrant Windows ecosystem. There is a subtle but important difference between success and relevancy in the technology world.

Windows Server was great for sharing files and printers inside the confines of a company, but the product was failing in the world of web sites and hosted services, even with significant marketing and programmatic support—today we call this cloud computing, but back then we called it ASPs or ISPs (internet service providers) or just hosters. The challenges didn’t stop with the operating system. The server programming models used on any of the exciting new consumer web services were not using Windows. Our own HotMail continued to resist the Windows platform. Even among the best LORG customers, Windows Servers were mostly used internally, and Linux, a free implementation of the Unix operating system from another era, was the preferred operating system for corporate internet sites, especially commerce and commercial sites. There were strong architectural and technical reasons, limitations, and costs associated with Windows, that facilitated the rise of Linux. Microsoft’s existing business made it impossible to compete with free without taking a major hit to revenue, or so the logic went.

MSN (short for the Microsoft Network), a collection of web-based information services emanating from RedWest (Redmond West Campus), was front and center of the industry, but the financial losses kept mounting with no end in sight. In this sense, Microsoft was consistent with the rest of the internet world. Internet competitors weren’t making a lot of money, especially in comparison to Windows, Server, and Office. For example, market-leading and era-defining Yahoo booked about $600 million in revenue in 1999 while losing money to being marginally profitable—it was unclear whether that concerned or excited us.

Microsoft’s enormous success selling a business vision was hiding the fact that these core products were failing in equipping the new internet platform. While Microsoft was making the most money, the internet was increasingly being run and programmed using non-Microsoft and, worse, free technologies.

Nothing made these aggregate challenges clearer than the enormous COMDEX tradeshow (historically an abbreviation of COMputer Dealers' EXhibition) in November 1999. It was perhaps the largest tradeshow event ever at the time and still a record-holder in the United States. The show had come a long way since the Halt and Catch Fire era just 15 years earlier. Every hotel room, convention space, and taxi were fully occupied for the week. The convention was electric, and massively, painfully crowded.

A funny thing happened as over 220,000 people made their way there that year: PCs became somewhat irrelevant. If this sounds frustrating, surprising, or even puzzling it was. Those very feelings consumed me as I definitely did not think we had ceased to be interesting or that the business we were in was boring.

The consumer internet took over COMDEX. Historically, the PC had been the heart and soul of COMDEX, but it suddenly faded in importance, and with it so did COMDEX. This marked the biggest and, effectively, the last of the show, as all the major PC makers left the following year. So it goes. The Consumer Electronics Show, CES, would become the go to show as COMDEX sputtered.

I saw the rise of the consumer internet during frequent trips to Silicon Valley and to PowerPoint, the 1987 acquisition that was based in Silicon Valley (with offices on Sand Hill Road no less) and remained there, never relocating to Redmond. The billboards on Silicon Valley’s highway 101 shifted away from networking and databases, the foundations of client-server, to the likes of Flooz, Pets.com, and Excite. These were the precursors to the dotcom bubble and the stock market crash that was still months away. Seattle wasn’t immune. Seattle’s newly hip Belltown neighborhood (awhere I had moved to a new apartment) was constantly circled by Webvan.com grocery delivery vehicles and one building was painted with what became an infamous logo for MyLackey.com, a concierge service summoned by a website with a retro-butler graphic.

The dotcom era was not about enterprise software but about consumer services delivered over the web. PCs were too complicated, and the industry, as I witnessed at COMDEX, was responding with a sea of internet appliances that were simpler, easier, and more reliable to use than PCs. The market spoke. PCs were too complex and bloated for the new e-conomy.

The result was that BillG’s keynote at COMDEX that year was all the more divergent. He spoke at length about Windows 2000 and Office 2000 improving reliability and getting work done, topics for the most part lost on the audience and even the press. Microsoft was not immune from the consumer internet though, building on WebTV, an acquisition Microsoft made in the appliance category (I was a huge champion of it, having been an early adopter and buying them for family). Microsoft introduced MSN Companion, an internet appliance for connecting to the internet over a phone line much like the dozens of devices on the tradeshow floor. The device ran Windows CE, a subset of 16-bit Windows that was about to become legacy code that ran on microprocessors from ARM. Compaq, eMachines, and others manufactured the devices, licensing the software from Microsoft in a business model (and code base) that presaged how Microsoft would enter the mobile phone business. These non-PC devices as we called them were big news.

MSN Companion came from the Online Services division. Microsoft, historically two cultures of Apps and Systems, spawned a third—Online Services, Microsoft’s foray into the consumer internet. As if to further emphasize the cultural divide, the online groups were located in a new campus, RedWest, about a mile down the street from the main campus. The brick buildings, identified by letters and surrounded by streams and pathways, were in contrast with the utilitarian stucco facades of the main campus with the lone Lake Bill in a near random series of numbered buildings.

The Online world was indeed a new culture, even though so many on the team came from Apps and Systems. There was arguably a degree of superiority emanating from RedWest, or perhaps inferiority from main campus. Everything seemed more exciting. Everything seemed more relatable to friends and family. Celebrities routinely visited RedWest and these visits were dutifully covered in MicroNews, the employee newsletter that eventually became an online intranet site. RedWest was to old-timers everything that the previous Consumer Division hoped to be, but instead of CD-ROMs it was web sites.

No surprise, the PC presence at COMDEX was brutal. I walked the show floor, systematically as usual. It was much more crowded than expected though the contrast from the previous year could not have been more dramatic. The effort to equip booths with Windows 2000 Ready signage was hopeless because the booths running Windows were on variants of Windows 95 for compatibility or simply because of laziness, as the much beefier Windows 2000 was still in pre-release and had been under development for so long most stopped paying attention. In fairness, Windows 2000 was not aimed at consumers, but at businesses—a necessary narrowing of focus due to the consumer hardware ecosystem that remained unsupported. Productivity tools such as printers were repurposed to show printing photos or CD labels. Email was shown but only when running on new internet appliances. Even digital signs that used to be PowerPoint running in loops were replaced by a new favorite gadget, digital picture frames (all running Linux and the latest ones natively connected to the internet).

Back in Redmond, after COMDEX, Microsoft was better able to compartmentalize the ongoing challenges. External stimuli can be disorienting if you’re a giant, successful company that has just successfully transitioned to a new era. At least that was what the press was telling us. And we believed them.

A favorite saying of mine is from Hemingway’s The Sun Also Rises:

How did you go bankrupt?

Two ways. Gradually, and then suddenly.

This is how technology change (or bankruptcy or disruption) happens to the successful. At first, changes take place slowly and mostly go unnoticed. In reality, they do not go unnoticed, but rather, they seem insignificant—especially in a large company where there is always someone shouting or emailing that “the sky is falling.” To paraphrase a line from the 1984 film The Adventures of Buckaroo Banzai Across the 8th Dimension: “No matter what happens, someone always said it would.” It seemed there were quite a few people readying themselves to be able to say, “I told you so.” Memos were flying around, and choice quotes from Innovator’s Dilemma made their way into every slide deck. Every week someone would pull something out of their Sent Items folder to remind others of their predictive wisdom.

Then much further out in time than anyone thought, the accumulation of these small, unnoticed changes pile up and compound into a huge, seemingly unstoppable wave. When faced with these small changes, the natural reaction is to look inward, brushing them off as . . . small and insignificant. There’s always plenty to do, and usually that seems really important and customers are demanding it. The outside world is shut out and the focus turns to self-determined goals and activities. You enter a bubble. It is a really big $500 billion bubble, but a bubble.

I constantly worried about the increasing distance between what we were doing and what seemed interesting to the world beyond Microsoft and business customers.

For us, it was the constant drumbeat of enterprise customers that was difficult to match. Microsoft expanded to tens of thousands of enterprise sales and support personnel in a strong, aggressive, and empowered field organization, a number that greatly outnumbered the product team. On the Office team, about 200 people were in the position to interact effectively with sales and customers, but they were busy designing, building, and marketing Office and customer demands greatly exceeded our capacity to interact.

It is a cliché to read business books and hear of success stories about product teams that get close to customers. I dove headfirst into every book I could find on learning from customers—from In Search of Excellence and Crossing the Chasm to books about customer-obsessed companies like Wal-Mart and General Electric. I quickly learned that those were almost always stories that did not have a natural analog with Microsoft’s products. Our products were complicated, like IBM or GE products, but they were used directly and differently by hundreds of millions of people. Even if a large company used Office, within the company Office was used as though each customer was unique.

The challenge we faced was that the Systems approach much more closely resembled the IBM or GE model of listening to customers, and the field loved that. While each MRI machine might be used and configured differently, there are only thousands of them in the United States. Each email server installation of Exchange had many unique elements, but there were only hundreds of them (at the time). Product groups like Exchange were the same size or bigger than Office but could easily develop high-touch relationships with the largest customers, and further support those with the dedicated field support being built up around the world. Even Windows had a level of indirection in that by and large the view of being close to customers from the Windows team meant being close to the 10 major computer makers, not to hundreds of millions of new PC buyers. The PC makers even handled the cost burden of offering customer support for Windows.

By contrast, Office was not only unique at the company level, but each company might have dozens of configurations, plus each individual might have a different type of PC, and certainly might have different software, printers, or other peripherals. It was the use cases that grew rapidly—companies generally converged on best practices for using and managing servers, but when it came to Office, diversity was the rule and hands-off was the support policy.

That was our strength. The Office team embraced that. The rest of Microsoft, especially field sales and the server products, did not see things the same way.

The lack of direct enterprise engagement looked like Office not listening to its customers, and that was a constant tension on the team and between organizations. We (specifically, me) were not quick to jump to the customer crisis of the moment or to dedicate resources to understanding the latest hot customer scenario or problem. There was always a desire to dedicate resources as a show of customer love. At any given time, there were thousands of these that we knew about, and countless individuals struggling somehow with the product.

By listening to what percolated through support or executive escalation, we risked having the product team be driven by anecdote and squeaky wheel. Customers and partners were rewarded if they escalated, no matter what connection they would use. Every time SteveB or a senior exec returned from visits with the field, the escalations would follow. I always knew who was visiting customers as a trail of emails would land in my inbox.

Office continued to maintain the highest satisfaction ratings among products (and among product development teams), a fact I resorted to sharing. The brand consistently stood for “ease of use” in the eyes of customers. We continued to win head-to-head reviews. The Office Advisory Council, OAC, was our key enterprise customer learning tool and our OAC members loved the depth of engagement.

Becoming an enterprise company was a journey. In the late 1990s, the enterprise companies were Netscape, IBM, Oracle, Sun, HP, and SAP, and in Japan companies like Fujitsu, NEC, and Hitachi ruled the landscape. Wall Street made up fun names for these two groups. NOISE referred to the US companies Netscape, Oracle, IBM, Sun, and everybody else. The Japanese tech industry referred to FNH for Fujitsu, NEC, and Hitachi. Take that FAANG. Microsoft was not a consumer company but more of a vendor to enterprise companies than a partner, especially Office. In a sense, Office became part of the enterprise fabric or infrastructure but not part of enterprise decision-making.

One view was that we were not invested in the dialogue. We were, though not with every customer and that was a problem.

Another view, and what I believed, was that the dialogue was about server infrastructure and Office was personal productivity. The IT world was about servers, just as they were about mainframes. They viewed the desktop as far less strategic. Servers were strategic buys. Office was a must-have, but also a transactional purchase, except for Outlook which was strongly connected to Exchange Server. IT provided email as a service to employees, so it was held in high regard.

The question was whether my view was limiting, convenient, or expansive.

Starting with Y2K planning early in 1999, company-wide efforts on building enterprise trust dramatically increased. The company was rapidly shifting. In SteveB’s words, we were out there “selling what we built” as enterprise salespeople, but we needed to “build what we could sell” as enterprise product makers.

With SteveB’s appointment to CEO in 2000, Microsoft was, as he said, “all in” on enterprise. BillG was completely and deeply engaged in the design of future products as chief software architect (CSA), his newly created title. Our company-wide processes from planning to budgeting, and especially marketing, changed dramatically with the shift to enterprise leadership. SteveB was the sales leader and that permeated company operations.

The implications were broad. Aside from choosing features that enterprise customers valued, several separate yet significant enterprise-level initiatives were in flight, and each required cross-company product team collaboration and a connection to the global sales and support teams. While any might have taken place before (and many did), with SteveB as CEO these had sales urgency and top-down processes. I could see in all the communications an element of “as chartered by SteveB” or “we committed to get back to SteveB in 120 days” as, let’s say, reinforcement. Taken together they presented an opportunity for Office (and me) to be seen as an equal partner to enterprise customers along with Server teams.

These initiatives included getting ready for the changeover to Y2K, improving PC security, privacy, viruses, malware, crashes, and reliability, and the previously described support policy. These special projects were happening in parallel with building Office10 and stretched through the next release as well.

The Y2K changeover mobilized just about everyone at Microsoft as we saw across the entire tech landscape. Microsoft was almost giddy in preparation. We seized on the opportunity to have a crisis that seemed like a fun technical puzzle. Every product we released going as far back as you could imagine and every company system were exhaustively tested and verified. We had a Y2K operations center, complete with generators and food supplies. Every communication system was made redundant for the rollover. What seemed at first to be a big headache was kind of fun for everyone that spent a year in preparation. The virtual team took great pride in tracking down obscure products and finding compliance issues, documenting them as part of the elaborate classification of Y2K readiness. Microsoft was as surprised as anyone that the new millennium got off to a glitch-free start.

Microsoft already had a few run-ins with regulators regarding privacy of early online services, but the growing internet was creating a whole new set of concerns especially when considering some of the services we were running at massive scale such as HotMail. Similarly, computer viruses that were once nothing more than an annoyance had become business critical problems. The next section is dedicated to the history and building a company-wide response to this challenge.

Y2K was one class of potential bug, but in practice our products had not made much progress in terms of quality over the past ten years. Office was incredibly solid, but if there was a problem then invariably all the customer’s work was lost. Such catastrophic loss was very bad for one consumer but entirely unacceptable to enterprise customers. Server products had their challenges with scale, configuration, and network management. Windows made significant improvements going from the 16-bit to the new 32-bit code base, but for new computers Windows 2000 lacked support for most consumer software and required more memory and disk space than PC price points could support. In a follow-on section, the innovations Microsoft introduced that radically changed not just our products but how developers thought of using the internet to improve software quality and reliability will be detailed.

Working on each of these brought a level of cooperation and collaboration across the company that we had not seen previously. Soon we were sharing best practices and thinking more broadly about how to be proper engineers more than hackers. As one indication of the importance of this change, JonDe, who had led Office for so long, would take on a broad role of creating an Engineering Excellence organization to formalize this type of cross-company maturing.

Individually, each of these initiatives seemed, especially in hindsight, seemed trivial or even obvious and basic work we should have been doing all along. It wasn’t so simple. So much was going on and everything was happening so fast, with so much potential for failure on much larger issues, that it took time to catch up to understanding the situation. From a team perspective, these were milestones or perhaps tests on the journey moving from products for tech enthusiasts to a platform for enterprise computing. Taken together, these represented a step-function change in the perception and reality of product quality and business readiness. Tech enthusiasts were not only more tolerant of these product quality issues but often embraced the foibles and prided themselves on knowing the ins and outs of products. On the other hand, LORGs were not only less appreciative of what they termed product defects but pointed to the very existence of them as proof that Microsoft was not ready, or even capable, of serving the enterprise. Industry analysts chided Microsoft for a lack of enterprise chops and often scored products lower because of this.

The special cross-company projects were meant to serve customers and were decidedly strategic for our existing customers. At the same time, they were not going to address the potential disruption from the changes we saw at COMDEX. It was easy to look inward, but I tended to view these as essentially taxes on the team. All “just work,” as we said. Others with a more near-term focus viewed these as innovation in the context of enterprise.

We were both right. We were both also wrong.

We needed to walk and chew gum at the same time. That need was not always clear. But more often, the whole of Microsoft was still more focused on these activities rather than what might happen in a few years.

On to 060. ILOVEYOU

This paragraph was added after original publication. I missed including these thoughts unintentionally from an earlier draft. The full release of Hardcore Software will have this paragraph as well.

Another great post!

Microsoft paid $1.5B? I guess Visio did have runway.

[This might be interesting to Visio acquisition fans. I already wrote most of it, so am just pasting it here if anyone's interested]

In 1995, I started an effort at Autodesk to acquire Visio. I flew up to Seattle and met with Jeremy, Ted, and Keith for a few hours, we got along great, and they were intrigued. This led to a subsequent meeting at SFO where our CEO Carol Bartz, our COO/CFO Eric Herr, and I met with Jeremy Jaech, Ted Johnson, and Doug Mackenzie who was their board investor from Kleiner Perkins at the United Club meeting room in Terminal 3 of SFO.

Doug was against our acquiring Visio, saying "we have plenty of runway and don’t need to be acquired any time soon" but Carol pointed out that no numbers were mentioned yet, so how did he know?

The next step was a day-long meeting in at the Renaissance Hotel on Madison in Seattle, where I brought with me the Office of the CTO which included myself, Carl Bass the CEO-to-be (in 10 years), and Robert Carr, creator of Framework at Ashton-Tate who headed up engineering at Autodesk after following me there from Go. We also brought our Eric Herr and Chris Bradshaw, the Director of Product Management for AutoCAD LT. Co-founders Jeremy Jaech, Ted Johnson, Peter Mullen, Gary Gigot, and Dave Walter, and a couple of other people whose names escape me represented Visio.

We met for 8 hours. They had recently hired an ex-Autodesk product manager who was moving them towards technical drawing through the clever use of their shape technology to add things like implementing CAD drawing dimensions as Visio shapes, with dimensions changing based on Visio shape relationships rather than CAD-oriented dimensioning, which is more computationally complex and can be confusing to “breadth CAD” users. Their main architect Dave admitted that the number of entities in Visio was limited by their then-current architecture, so we felt no immediate threat from them in terms of scalability to our space. But we thought their user experience was great and their product had the most robust use of OLE outside of Microsoft we had seen so far. In fact, I joked with Jeremy that they were the “Fifth Beatle” of Office (see Murray the K), even though they were outside of Microsoft. In fact, I had heard there was an Office bundle that included Visio in Japan, supporting my argument/joke. My teams were all in on OLE as well, so we loved Visio’s overall approach towards lightweight design tools and Office integration for breadth users of CAD.

The Visio Technical product threat they made towards us was a good strategic move for them, as they saw Visio as a product in the center of a competitive triangle that included: a) PowerPoint adding smart shapes, pushing into their core; b) Adobe IntelliDraw which was eating into Visio’s market share with smart shapes and line snapping; c) AutoCAD LT, our less expensive, non-programmable AutoCAD for technical drawing. Thus, they had one perceived weak direction to go in, and that was to attack us, so they were looking to move towards the Autodesk market for lightweight CAD. This confirmed the original concern that started the build/buy process for our new thrust towards a “lightweight CAD” market; someone like Visio would try to go after these customers, which could be an assault on Autodesk from the lower end. We were correct in our assumption.

We subsequently offered them something south of $200M, which Kleiner declined to support, and I thought undervalued, though I was outvoted by our COO (my boss).

So, Microsoft paid $1.5B? I guess Visio did have runway. That was about 10x what we offered.

Visio belonged at Microsoft anyway. I left Autodesk a year after this, to pursue other things. Visio went public soon after our brief dalliance. Visio later acquired an AutoCAD clone which AutoCAD had to spin out of an acquisition. This created some ill will between Autodesk and Visio, but not much ever became of the clone to concern Autodesk in the long term. The clone is still around, but we outcompeted them.

After I left, Autodesk created a product called Actrix to compete with Visio because of their frontal assault on AutoCAD with the clone. Actrix was interesting, but five years too late. Visio lost interest in our space once Microsoft acquired them, so that threat had diminished anyway. Godfrey Sullivan, the product leader for Actrix (the EVP of Sales, for some reason) became CEO of Hyperion and Splunk, so it clearly didn’t hurt his subsequent trajectory.

We were simply wrong in 1996 – users did not want a consumer CAD product, and Visio would never grow the CAD DNA necessary to compete with us.